Is Active Management a Fool's Errand? Tech Insiders and the Case for Informed Stock Picking

Is Active Management a Fool’s Errand? Tech Insiders and the Case for Informed Stock Picking

Bottom Line

The vast majority of individual investors and active fund managers fail to beat the market over the long run. But some do—and many of those who succeed have something in common: deep domain expertise. In this article, we explore whether tech and biotech professionals, with their training and industry insight, may have an edge in stock picking—if applied wisely.

Background: Revisiting Active Management in Tech

In my previous post, I broke down some of the challenges in active fund management especially with tech stocks, using ARK Invest as a case study: Stock Picking in Tech: When Domain Expertise Matters

I wanted to expand on my previous assertion that STEM trained individuals with industry experience could have advantages for tech stock picking. Do these professionals in the tech or biotech industries have real, applicable insight into markets—especially in highly technical sectors, and does that translate to better portfolio performance?

I’ve long been hesitant to invest in actively managed funds because I noticed many of their stock picks were misaligned with my expectations as someone working in the biotech industry. I had some overconfidence that I was great stock picker by my own initial good results in 2021, but then later took huge losses on stocks I invested in—such as Moderna and BioNTech—due to underestimating macroeconomic and geopolitical headwinds. This lesson gave me a great deal of humility - fortunately some of my computer-related tech stock picks made up for these losses (an area I knew much less about).

Still, I’ve seen individuals in the tech space achieve exceptional returns by identifying transformative products and trends early. I think many of us know “that person” who keeps bragging about his/her early Apple and Bitcoin picks and is doing very well now! That got me thinking: is there such a thing as an insider advantage for public-market investing?

🧠 Why Tech and Biotech Professionals Might Have an Edge

1. Information Asymmetry & Industry Fluency

- Technical Vetting: A software engineer or scientist can evaluate a company’s claims with a degree of skepticism and understanding a generalist might lack.

- For example, distinguishing between real AI development versus thin wrappers around open-source models.

- Analytical Abilities: STEM trained individuals like scientists, engineers, and mathematicians have analytical abilities which are often the keys to their success

- Being able to quantitatively model, compare, and identify trends is extremely useful for stock picking and analysis

- Jim Simons (mathematician/investor, Renaissance fund) is a great example of this: Jim Simons: Success Story, Net Worth, Education, and Top Quotes — Investopedia

- Talent Flow as a Signal: Scientists and Engineers often know which companies are attracting top talent—and which are hemorrhaging it. Talent movement is often a leading indicator of innovation.

- Product Ecosystem Intuition: Insiders recognize sticky ecosystems before the rest of the market catches on—such as developer platform effects, API utility, or product-led growth.

2. The “Industry Local” Effect

- Academic studies have shown local investors tend to outperform due to proximity and informational advantages (Coval & Moskowitz, 1999).

- In a digital world, being an industry local—rather than geographic—may matter more. Engineers, data scientists, and product leads are exposed to market shifts months or years ahead of Wall Street analysts.

3. Crypto & Web3 Case Study

- Crypto is a domain where deep technical literacy matters. Understanding codebases, tokenomics, and developer activity creates real informational edges.

- Traditional funds often chase hype. Engineers who understood fundamentals invested early in Bitcoin, Ethereum, Solana, and more.

📉 The Other Side: Why Most Still Underperform

1. Market Efficiency in Large Caps

- For big public tech names like Apple or Nvidia, it’s unlikely that an individual has insights not already priced in by the market.

- These companies are covered by thousands of analysts. It’s hard to beat the crowd.

2. Data on Individual Investor Underperformance

- DALBAR’s Quantitative Analysis of Investor Behavior (QAIB) shows the average investor earns ~3% less than the S&P 500 annually, mainly due to poor timing.

- The landmark study “Trading is Hazardous to Your Wealth” (Barber & Odean, 2000) found that the most active traders had the worst performance. Overconfidence and excessive trading were key drivers.

3. Behavioral Biases

- Overconfidence Bias: Experts overestimate their own ability to pick winners.

- Familiarity Bias: Over-investing in tech when one’s job, salary, and portfolio are already correlated to the same sector.

- Confirmation Bias: Emotional attachment to a specific technology can cloud judgment.

✅ Examples of Active Managers Who Did Beat the Market

Here are two active funds that beat the S&P 500 over the long run by taking informed bets in tech:

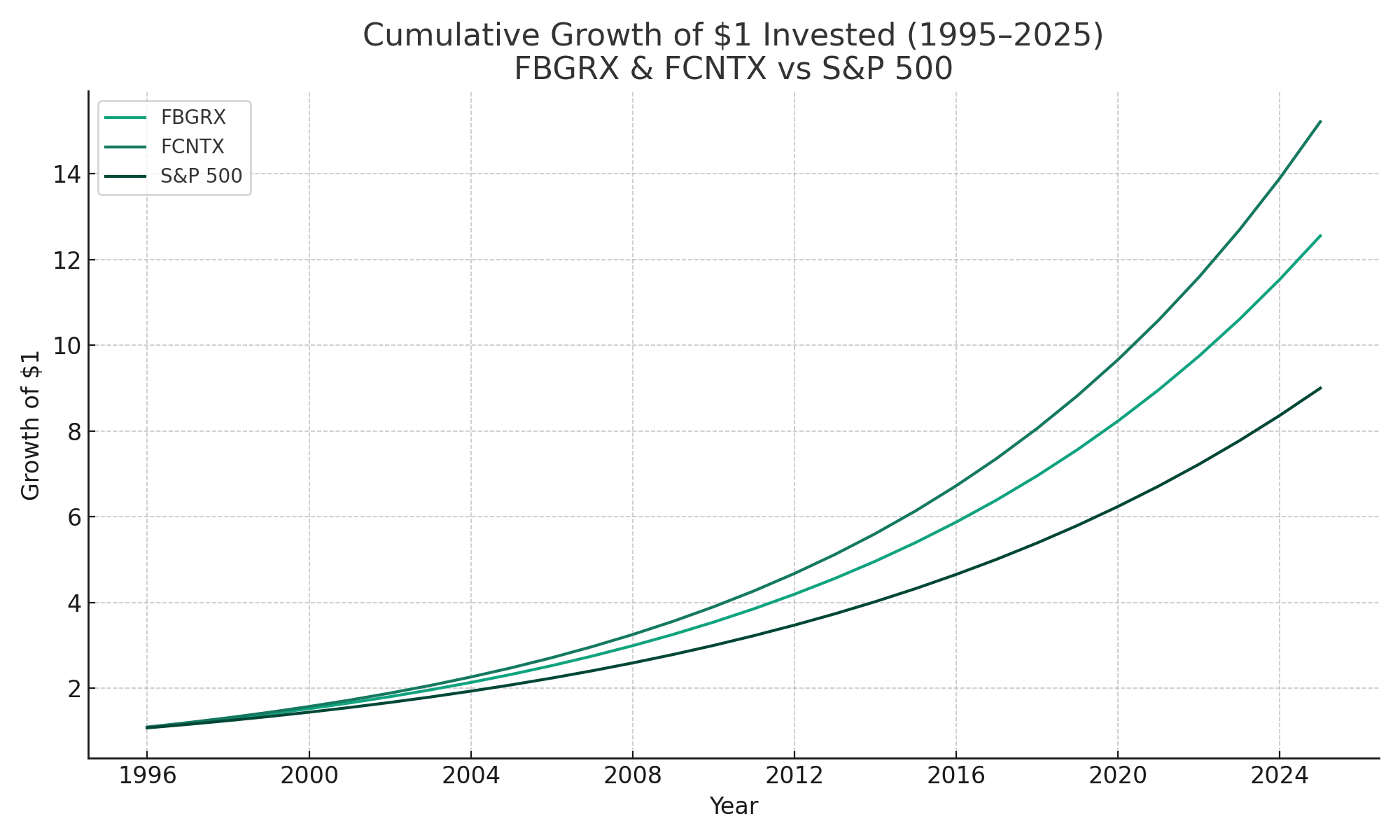

| Fund | Strategy Style | 30-Year Return vs. S&P 500 | Key Holdings | Notes |

|---|---|---|---|---|

| Fidelity Contrafund (FCNTX) | High-conviction large-cap growth | 9.5% vs. 7.6% per year | Meta, Amazon, Nvidia | Emphasizes management quality and secular trends |

| Fidelity Blue Chip Growth (FBGRX) | Tech-forward growth strategy | 8.8% vs. 7.6% per year | Microsoft, Apple, Nvidia | Strong bottom-up research with a tilt toward innovation |

📌 These funds succeeded not by chasing hype, but by combining rigorous research with domain awareness.

The fund managers (Will Danoff (FCNTX) and Sonu Kalra (FBGRX))are highly regarded and not in the tech industry, showing you don’t necessarily have to be an industry expert to pick well. I’m curious to see who they had on their teams to help with the analysis. It’s also important to note these funds focus on large cap stocks which have more stable and predictable performance than small and mid cap stocks. I’d argue that the more speculative and unpredictable the investment for tech, the more having insider and deep knowledge could benefit stock-picking.

Below is an article with examples of successful active funds of the past decade, which also expands on the strategy of FBGRX:

The Top-Performing Actively Managed Funds of the Last Decade — Kiplinger

📊 Long-Term Performance of FCNTX & FBGRX vs. S&P 500

💬 Anecdotes from the Tech Trenches

On forums like Reddit’s r/investing - constant outperformance, r/investing - beat the market, and r/ValueInvesting - is it worth buying tech stocks now?, you’ll find stories of individuals who bought and held companies like Apple, Nvidia, or Microsoft early. Some of them were:

- Engineers impressed by chip architecture or product reliability

- Developers excited by SDKs or developer support

- Professionals who noticed which companies were driving adoption inside their own workplaces

These stories show that even without professional investing credentials, deep familiarity can result in prescient bets. In addition, I personally know of more than a few lucky, smart (or both) investors who invested in their domain of expertise with fantastic results.

But are they cherry-picked outliers—or a real pattern? Unfortunately, hard data is limited.

🧪 What About Biotech Professionals?

I’d argue picking stocks for biotech is very challenging (perhaps more so than traditional tech). While domain expertise is critical for understanding clinical pipelines, many biotech stocks are long-term plays with high volatility.

My personal experience of holding on to Illumina stock (DNA sequencing) while I worked there was fueled by my strong belief and pride in helping to build their products. I ended up selling the stock at reasonably good times out of luck - I didn’t expect many of the challenges with the GRAIL acquisition to cause such a quick erosion of the stock price after I left the company. My experience highlights the emotional pitfalls, but the potential for an intellectual edge still exists. For instance,

Biotech Professionals can:

- Better evaluate clinical trial progress and regulatory hurdles

- Understand the technology and science behind the products and evaluate if they realistically will have effective, robust, and reliable performance

- Have a better understanding of product development processes, costs, competition, and timelines

- Understand market potential and adoption timeline for scientific platforms (e.g., mRNA, CRISPR, new sequencing technologies)

But even insiders can misjudge execution risk or underestimate macro effects, like interest rates, pandemic cycles, and new geopolitical issues. Individual stock pickers and funds such as ARKK have a very challenging job in identifying biotech stocks that will be hugely successful in a 5 year horizon because they often reside in the small or mid cap space and have much higher volatility than large cap stocks. I have yet to identify active funds with large biotech allocations that have been able to do this with high success, especially given the large downturn of the industry within the last few years. If you know of any, please let me know!

📦 Product-Led Investing: The Lynch Approach Today

Not all successful tech stock pickers come from STEM backgrounds. As demonstrated by the long-term outperformance of funds like FCNTX and FBGRX, active managers can succeed through disciplined, fundamentals-driven approaches—even without technical industry expertise.

But there’s another school of thought that has worked well for some individual investors: product-first investing, popularized by Peter Lynch.

This strategy leans on intuitive insight: if you use a product, love it, and see it gaining traction, that firsthand experience can be an investing signal—if paired with solid business analysis.

Examples include:

- Early adopters of Apple in the 2000s who believed in the iPod, iPhone, and ecosystem before Wall Street fully caught on.

- Binge-watchers who recognized Netflix’s user loyalty and disruption potential.

- Shoppers who understood the Amazon Prime flywheel, or saw the growing cultural footprint of Spotify.

“The best stock to buy may be the one you already know — because you’re a customer, a user, or someone who sees the business thriving in everyday life.”

— Kiplinger, “We Are Peter Lynch”

“The individual investor is best equipped to recognize good companies because they interact with the products and services daily — often before Wall Street catches on.”

— Investopedia, “Pick Stocks Like Peter Lynch”

“Invest in what you understand, and then do the homework to confirm the business fundamentals.”

— AAII, “The Peter Lynch Approach”

This kind of investing doesn’t require a technical degree—but those with STEM training and industry experience may be even better equipped to spot transformative technologies, especially when combined with real-world product enthusiasm. I’ve seen this firsthand among colleagues who invested early in companies like Apple, Amazon, or Netflix—not because of financial modeling, but because they loved the product and understood the underlying tech. Here are some anecdotes of those kinds of cases on reddit: Reddit: How Did You Find the Stock That Hit It Big?

That said, not all popular products translate to winning investments. Companies like GoPro and Fitbit were widely loved by consumers but failed to build durable competitive advantages or sustain growth.

⚠️ The takeaway: Product insight can be a powerful edge, but only when paired with business discipline.

🧭 Conclusion: A Nuanced Strategy

It is possible to beat the market with active management—but only if:

- You have true insight that isn’t already priced in

- You apply rigorous analysis, not just hunches

- You manage behavioral biases and diversify appropriately

- You are lucky in your timing (e.g., tech boom, low interest rates, etc.)

Suggested Approach:

- Use a “Core and Satellite” strategy

- Core: Broad index funds (e.g., S&P 500, Total Market)

- Satellite: A small allocation (% depending on your starting wealth) for active bets based on industry or product insights

- Revisit your hypotheses regularly and be willing to cut losses

- At the same time, evaluate if the companies are worth holding for the long term (Nvidia and Apple are good examples)

- Don’t confuse product love with investment logic

Happy Investing, and Good luck!