What Makes a Great Stock Picker in Tech?

What Makes a Great Stock Picker — and Where ARK Invest Falls Short

I’ve been interested in how different stock-pickers (like actively managed funds) can get more publicity than others, especially when they are championing the technology sector. As a scientist, I think it’s very important to evaluate with skepticism the substance vs. hype of investment strategies. ARK Invest, led by Cathie Wood, rose to fame by aggressively investing in emerging technologies—from gene editing to autonomous vehicles and crypto infrastructure. Their pitch? Deep research, open-source models, and a bold long-term vision.

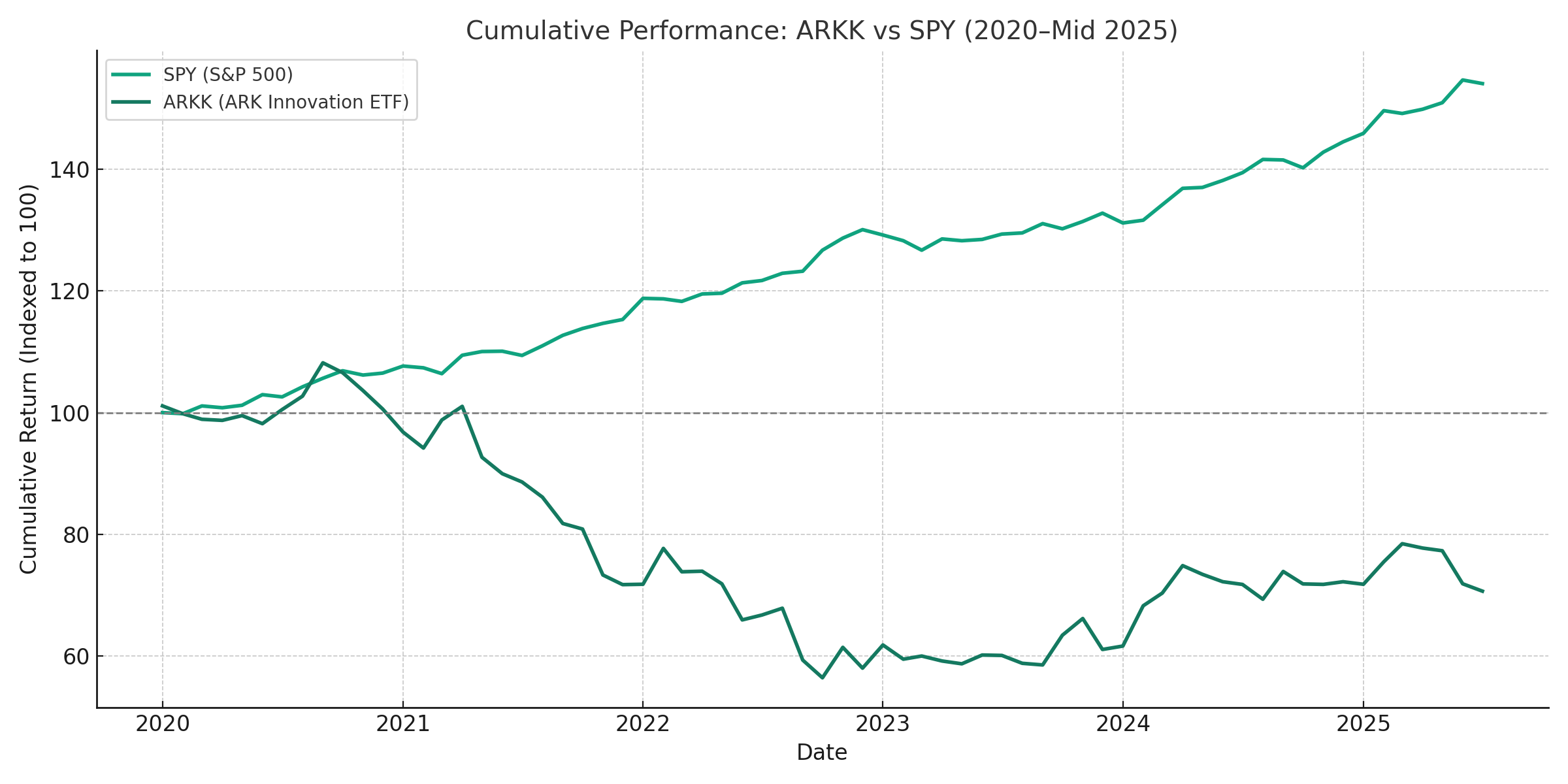

But with ARKK (the flagship ETF) down significantly from its 2021 highs, and most of its holdings underperforming the market, it’s worth asking: what really makes someone a successful stock picker in the tech space? And why did ARK, despite its data-driven narrative, fall short?

Bottom Line

Be skeptical of active fund managers who promise outperformance. Before investing, ask: do they have a proven team, a sound strategy, rigorous and grounded analysis, and reasonable fees—or are they selling hype and overconfidence?

Even the most experienced and educated investors rarely (<10%) get better long term returns than investing in simple, low fee, and broad index funds (such as S&P500 based funds). Most people are probably better off with a simple and low-cost investment strategy such as the Bogleheads methodology, which can be further extended for the future. See these blogs:

That said, I’m not completely against active management and investing a minority amount of your wealth in individual stocks/crypto as long as you are able and willing to take large risks. I’ve seen legit examples where these strategies can work both with individual investors and some active funds which I discuss in this follow up article Stock Picking: Is it a Fool’s Errand?

👤 A Personal Perspective

Despite having technical degrees and over 14 years of biotech industry experience—including working on R&D teams that successfully launched impactful products—I have had mixed results with individual stock picking. For example, many of my biotech investments after the COVID boom performed poorly despite deep fundamental research, technical competitive analysis, and attempts to buy dips.

Some of my wins did come from careful research, buying dips, and engaging with others in the industry, but I acknowledge that luck also played a significant role. The irony is most of my wins were through computer-related tech and driven by an AI revolution that I did not see coming so fast. This experience underscores how difficult stock picking can be, even for those with relevant expertise.

If I’ve faced such challenges despite my technical background and extensive industry experience, it suggests investors should be cautious about relying on funds and analysts who—even if they have some education in the field—lack hands-on industry experience. Without practical exposure, their stock picking may lean more on enthusiasm than on deep, grounded understanding.

I do enjoy challenging hype-machines and overblown narratives, which does give me some advantages in stock picking. But at the same time, I probably have lost out on buying some good speculative plays which I was too pessimisstic about.

💡 My Philosophy on Stock Picking

Speculating in individual stocks or cryptocurrencies can be very fun and educational, but it should only be undertaken by those comfortable with significant risk—and only after establishing a secure financial foundation. This foundation typically means having sufficient savings and diversified investments in broad index funds, especially within retirement accounts.

While there are many factors investors can control and anticipate—such as rigorous research, technical analysis, and risk management—even the best-researched picks can fail due to unpredictable macro events, geopolitics, competition, internal management issues, or execution risk. Recognizing this balance between control and uncertainty is key to managing risk and maintaining a balanced portfolio.

✅ Traits of a Strong Stock Picker (Especially in Tech):

Deep Domain Knowledge

A strong tech investor doesn’t just follow trends—they understand the underlying science and engineering. They know how to distinguish between a breakthrough and a marketing pitch.

Practical Industry Experience

Experience working in relevant industries helps investors assess what’s feasible and what’s fantasy. Understanding time-to-market, technical challenges, competition, regulatory bottlenecks, and supply chain friction is key.

Realistic Modeling & Risk Awareness

Sophisticated models are useful—but only if based on grounded assumptions. A good stock picker stress-tests downside scenarios and avoids overfitting projections to over-optimistic outcomes.

Good Judgment About People

You don’t need to be a scientist to invest in science—you just need to know how to find credible operators. Warren Buffett never built semiconductors, but he knows who can.

“You don’t have to build the rocket. You need to know whether the rocket scientist is full of it.”

⚠️ Where ARK Invest Went Wrong

Despite publishing Monte Carlo models and talking extensively about their research process, ARK made several missteps that reveal a pattern:

Overestimated Market Potential

- ARK’s Tesla model forecast $4 trillion market cap by 2025, assuming widespread robotaxi adoption (currently $950 billion).

- Their Zoom model predicted massive platform expansion despite increasing competition and user churn post-COVID.

- 👉 ARK’s Tesla Model (GitHub)

- 👉 ARK’s Zoom Model

Underestimated Time to Market

- Investments in CRISPR (gene editing) and autonomous vehicle platforms assumed near-term commercialization.

- In reality, these require multi-year development, regulation, and validation.

Shallow Competitive Analysis

- Overlooked competition from Big Tech (e.g., Microsoft vs. Zoom, Amazon vs. Teladoc).

- Underestimated bundling dynamics, pricing pressure, and technical moats of rivals.

Flawed Modeling Techniques

- Monte Carlo outputs were based on optimistic parameters and failed to model downside correlations.

- Industry analysts have criticized the models as overfitted, structurally fragile, and assumption-driven.

- 👉 Critical review: Beware of Monte Carlo

Mismatch Between Stated Philosophy and Action

Proponents rightly point to ARK’s stated five-year investment horizon, arguing that it’s too early to judge their strategy and that the recent downturn is merely cyclical. However, this defense overlooks two critical issues:

- The problem isn’t just that the stocks went down; it’s the foundational flaws in how they were valued—based on fragile models that underestimated real-world friction.

- For a fund claiming a long-term view, ARK has historically shown high portfolio turnover, often appearing to chase momentum rather than holding with conviction through volatility.

This behavior contradicts its own narrative and contributed to steep drawdowns for investors who bought in near the peak:

👉 Barron’s: ARKK Investor Losses

Team Experience Gaps

- Many ARK analysts lack extensive STEM training or operational credentials.

- Some of the public-facing analysts have limited industry experience and demonstrated successes which may not match the complexity of the tech businesses they’re analyzing.

📉 Table of Key Missteps

Below is a table showing some key missteps for ARK’s strategy and analysis. You can also see a chart below showing that you would have had substantially better performance investing in a low cost index fund (S&P 500) instead of ARKK in the period of 2020-2025.

| Company | ARK Thesis | The Reality | Key Error |

|---|---|---|---|

| Tesla | Robotaxi dominance | FSD limited to pilot cities; Waymo and others gaining ground | Time-to-market, competition & tech overreach |

| Zoom | Communication platform domination | Revenue stagnation, competition | Ignored bundling & enterprise trends |

| Teladoc | Telehealth disruptor | Write-downs, Livongo flop | Weak moat vs. Big Tech & insurers |

| CRISPR (CRSP) | Curative biotech | Trials delayed; no product revenue | Regulatory & clinical drag |

| Roku | Platform for ad revenue | Hardware commoditized | Missed competitive pressure |

Figure: Comparative performance of ARK Innovation ETF (ARKK) vs S&P 500 (SPY) from 2020 to mid-2025.

🔍 Contrasting with a Disciplined Approach

So, what does a more grounded approach to tech investing look like?

In contrast to ARK’s top-down narrative style, many successful long-term investors exhibit starkly different traits. Managers who are former engineers or operators, with decades of experience in the industries they now analyze can provide more grounded approaches. Their method is less about forecasting a multi-trillion dollar market and more about a bottom-up analysis of a specific company’s technology, its unit economics, and its management team’s ability to execute.

Their public commentary focuses on durable competitive moats and paths to profitability, not just disruptive potential. This approach may seem less exciting during a hype cycle, but it builds a portfolio on a foundation of disciplined skepticism, designed to weather the friction where theory meets reality.

That said, I acknowledge I engage in some “high risk” behavior like keeping many of my biotech stocks long term despite their volatility because of their grand visions. This is because I have a strong belief in the technology and am rooting for their success! The reason why I got into the biotech industry was to positively impact human health and enable scientific research, and so I’m willing to take some losses due to my conviction.

I also acknowledge it is very easy to look in hindsight and criticize poor performers. I do think many of the ideas of the ARKK fund were innovative and interesting, and some of the issues the fund’s allocations were hard to predict. Perhaps the next generation of funds will balance bold vision with operator-level diligence—pairing macro narrative thinkers with technical domain experts to vet execution risk early.

🧠 Final Takeaways for Investors

- STEM training helps, but it’s not enough—what matters is how technical insight is applied.

- Non-STEM investors can still win by identifying credible, experienced operators and filtering hype.

- Before investing in any fund, read the team’s bios. Ask: “Would I trust them to work in the companies they’re analyzing?”

“Expertise doesn’t guarantee success—but lack of it guarantees blind spots.”

If you’re investing in innovation, you need more than optimism. You need disciplined skepticism, real-world filters, and people who know where theory meets friction.

⚠️ Important Considerations: Stock Picking is Not for Everyone

While this article outlines principles for a disciplined approach to tech stock picking, it is crucial to understand the broader context and inherent challenges:

- This is Not Financial Advice: The insights shared here are for informational and educational purposes only and do not constitute personalized financial advice. Your unique financial situation, risk tolerance, and goals should always be discussed with a qualified financial advisor before making any investment decisions.

- High Risk, No Guarantees: Investing in individual stocks carries significant risk, including the potential for substantial or even total loss of your investment. There is no guarantee that applying any specific strategy, including those discussed here, will lead to profitable outcomes. Past performance is not indicative of future results.

- The Odds Are Against Active Management: Academic research and historical data consistently show that the vast majority of active investors – both professional fund managers and individual investors – fail to consistently beat broad market index funds over the long term, especially after accounting for taxes and trading costs.

- Significant Time and Effort Required: Successful stock picking demands a substantial and ongoing commitment to in-depth research, continuous learning, and monitoring. This level of dedication is not suitable or feasible for most individuals.

This article is intended for those investors who, having fully considered these risks, choose to dedicate significant time and effort to individual stock selection and seek to apply a rigorous analytical framework.